Section #19 - Regional violence ends in Kansas as a “Free State” Constitution banning all black residents passes

Chapter 216: The “Panic Of 1857” Rocks The Economy

1850-1855

A Previously Strong Economy Suffers A Set Back

While Buchanan is preparing to face off against the Mormons in Utah, the U.S. economy is suddenly struck by another financial panic.

This arrives after roughly two decades of healthy growth and relative stability, following Jackson’s July 1836 Specie Circular order which sets off a “run on the banks” and public distrust of soft money. The result, in that case, was a true and lasting depression, with GDP standing at $1.568 Billion in 1843, down from $1.598 Billion in 1838.

The only sizable downturn since then occurs a decade later, in 1848-49 as overheated production output associated with “Polk’s War” in Mexico is met by a sudden peacetime slowdown in demand.

GDP Trends During And Just After Polk’s Term

| 1845 | 1846 | 1847 | 1848 | 1849 | |

| Total (000) | $1859 | 2065 | 2410 | 2427 | 2419 |

| % Change | 9% | 11% | 17% | 1% | NC |

However, a rebound soon follows, largely fueled by the growth of the railroad industry — and GDP gains average a very robust +9% per year up through 1855.

GDP Trends During The Fillmore/Pierce Administrations

| 1850 | 1851 | 1852 | 1853 | 1854 | 1855 | |

| Total (000) | $2581 | 2724 | 3066 | 3311 | 3713 | 3975 |

| % Change | 7% | 6% | 13% | 8% | 12% | 7% |

Suspicions about the sustainability of these rates begin to appear in 1856, and continue into 1857. In June of that year an article published in the New York Herald proves particularly prophetic as to what lies ahead and why:

What can be the end of all this but another general collapse like that of 1837, only upon a much grander scale? The same premonitory symptoms that prevailed in 1835-36 prevail in 1857 in a tenfold degree. Paper bubbles of all descriptions, a general scramble for western lands. . . . The worst of all these evils is the moral pestilence of luxurious exemption from honest labor which is infecting all classes of society.

The actual slowdown kicks in during 1856, as growth falls to a paltry 2%. It continues through the next two years, culminating with a loss of (2%) in 1858.

GDP Slowdown Early In Buchanan’s Term

| GDP | 1856 | 1857 | 1858 |

| Total ($000) | 4047 | 4180 | 4093 |

| % Change | 2% | 3% | (2%) |

The effect of this “Panic of 1857” weighs heavily on the first two years of Buchanan’s presidency, compounding the troubles he already faces from the other domestic turmoil playing out in Kansas and Utah.

August 24, 1857

Failed Speculative Gambles On Railroads And Grain Exports Fuel The Meltdown

As usual, a key contributing factor in the “Panic of 1857” is rampant financial speculation by banks and other institutions.

In this instance, most of the betting centers on continued expansion of railroad lines across America. Total track mileage more than doubles between 1850 and 1857, which leads to investors eager to make a killing by buying up land they hope will fall along future routes. along future routes.

These purchases take money, and during the height of the railroad build-up, the number of chartered banks in America doubles, along with the amount of their outstanding loans. Jumps in both statistics are particularly pronounced between 1854 and 1857.

Banking Development From 1847 To 1857

| Year | # of Banks | Loans ($MM) | % Ch |

| 1847 | 715 | $310.3 | (1%) |

| 1848 | 751 | 344.5 | 11% |

| 1849 | 782 | 332.3 | (4%) |

| 1850 | 824 | 364.2 | 10% |

| 1851 | 879 | 413.8 | 14% |

| 1852 | 913 | 429.8 | 4% |

| 1853 | 750 | 408.9 | (5%) |

| 1854 | 1208 | 557.4 | 36% |

| 1855 | 1307 | 576.1 | 3% |

| 1856 | 1398 | 634.2 | 10% |

| 1857 | 1416 | 684.5 | 8% |

The problem, however, is that the railroad industry is already overbuilt relative to the actual demand that exists for commercial and passenger traffic at the moment. This becomes apparent during the crash, as many lines are forced to shut down, including the Michigan Central, Erie and Pittsburg, and the Ft. Wayne & Chicago.

Other speculative interest lies in acquiring public domain lands gained in the Mexican Cession of 1848. For some, the allure lies in mineral rights associated with various gold and silver finds in the west. For others it is simply the agricultural farmland that is already making America a leading exporter of corn, wheat and other grains to feed world markets. Unfortunately, the 36% jump in bank loans in 1854 corresponds with the British-French victory in the 28 month long Crimean War, which lessens European dependence on U.S. foodstuffs.

As demand for more railroads and grain exports slows, bankers, who have made loans to fuel the speculation, face more and more creditors unable to make their repayments. This pressures the bank’s reserves and their capacity to compensate depositors seeking money owed on their principal and interest.

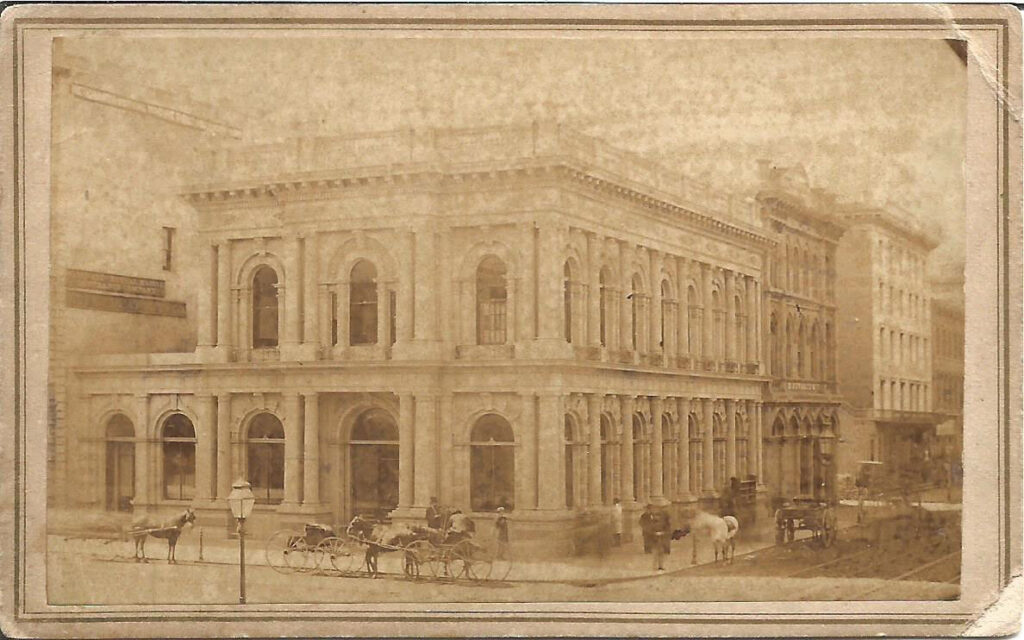

The proximate cause of the panic takes place on August 24, 1857, when a branch bank in New York City, owned by the Ohio Life Insurance and Trust Company of Cincinnati, tells depositors that it is unable to cash out their accounts.

News of this financial default spreads like wildfire across America, thanks to Samuel Morse’s telegraph, patented in 1847, and by 1857 connecting cities from coast to coast. What follows is the predictable cycle from 1836, with the public trying desperately to secure their life savings, often in minted coins, and the banks scurrying to secure the needed cash on hand, as well as replenishing their required reserves of “hard specie” in gold.

One hoped-for rescue on the supply of gold lies with the SS Central America, a 280 foot-long sidewheel steamer on its way from the California mines to New York City after a stop in Havana. Along with some 420 passengers and crew, the ship also carries nearly 500,000 oz. of gold bullion valued at $2,000,000, when it is hit by a hurricane and sinks off the Carolina coast. The loss further exacerbates the crisis underway.

(Note: in 1988 the ship is found by treasure hunters and, after legal battles, the gold is being sold off in 2018.)

1857-58

The Effects Of The Panic Linger For Two Years

Quickly enough many financial firms, including the Bank of Pennsylvania, suspend payouts in gold, which further undermines public confidence. To salvage their balance sheets, bankers also “call in” outstanding loans and tighten all forms of lending. Both moves further stifle economic activity.

In turn, unemployment levels spike, especially among the one-third of the labor force no longer making their livings on farms. Wage earners in the North will bear most of the brunt here, only adding to their general displeasure with the Buchanan administration.

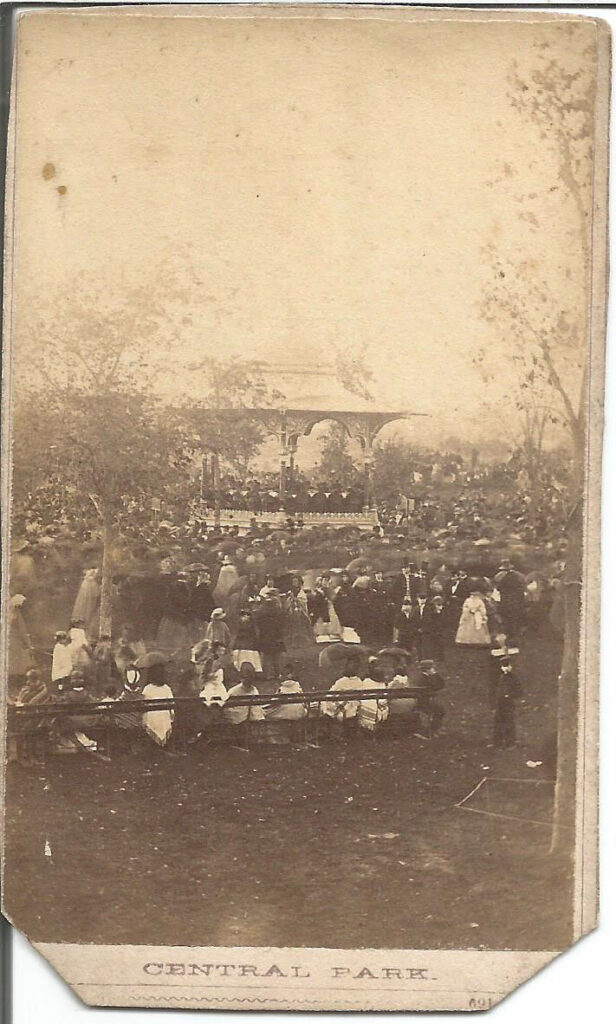

Repeated protest marches materialize, most notably in New York City, where demands are made that government take action to create jobs and protect citizens from the ravages of poverty and homelessness. Tammany Hall Mayor Fernando Wood responds first by calling out additional police and state and federal troops to quell the demonstrations, and then by hiring day laborers to work on city infrastructure projects, including the creation of New York’s Central Park.

The President reacts in his December 1857 message to Congress by fighting long-term inflation rather than attempting to address the need for liquid cash to support failing businesses in the short-run.

(I) require that the banks shall at all times keep on hand at least one dollar of gold and silver for every three dollars of their circulation and deposits, and if they will provide by a self-executing enactment, which nothing can arrest, that the moment they suspend they shall go into liquidation. I believe that such provisions, with a weekly publication by each bank of a statement of its condition, would go far to secure us against future suspensions of specie payments…Congress, in my opinion, possesses the power to pass a uniform bankrupt law applicable to all banking institutions throughout the United States, and I strongly recommend its exercise. This would make it the irreversible organic law of each bank’s existence that a suspension of specie payments shall produce its civil death. The instinct of self preservation would then compel it to perform its duties in such a manner as to escape the penalty and preserve its life.

Despite this threat, many banks appear this time to restrain the ruinous strategy of requiring that outstanding loans be repaid immediately, and in gold rather than greenbacks. Instead, they grant some amount of latitude to their debtors, thus allowing for a less severe downturn and a faster recovery than in Jackson’s recession.

GDP growth returns to the +8% level by 1859, before another slide in 1860 as the impending civil war looms.

Economic Trends: Buchanan’s Term

| 1857 | 1858 | 1859 | 1860 | |

| GDP ($000) | 4180 | 4093 | 4425 | 4387 |

| % Change | 3% | (2%) | 8% | (1%) |