Section #7 - A populist western president stands against Nullification and for tribal relocation

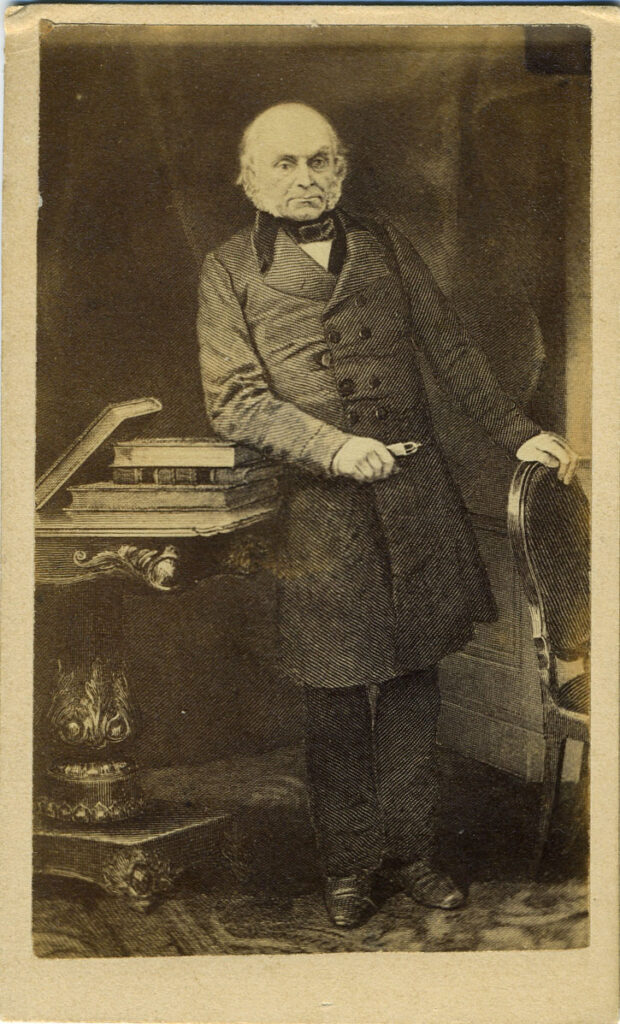

Chapter 57: John Calhoun Tries To “Nullify” Federal Authority

1828

Jackson’s Machiavellian VP Sparks The Nullification Crisis

Andrew Jackson’s running mate, John C. Calhoun. believes all along that his destiny is to become President of the United States.

He sees himself as the natural successor to the “Virginian line,” and, in chameleon-like fashion, executes a series of maneuvers aimed at bringing down various rivals in his path.

He begins with Adams, playing the sinister Iago against the President’s ever naïve Othello. He secretly torpedoes Adam’s (and Clay’s) internal improvement programs from within the Cabinet. When he sees that he cannot win the 1828 nomination, he abandons Adams and backs the opposition candidacy of Jackson.

Like JQ Adams, Jackson is at first taken in by Calhoun, and chooses him as Vice-President, making him only the second man ever to serve in that position under different presidents (joining founding father George Clinton).

But Calhoun always views Jackson as a crass “mobocrat,” lacking both executive capacity and grace.

If Jackson lives up to his promise of “one term only,” Calhoun has every intent of becoming his successor.

To do so, however, requires an issue that captures public attention, and a solution that he can champion.

The issue he settles on goes all the way back to the 1787 controversies over the sovereignty of the states vis a vis the authority of the central government. Calhoun decides that it is time to play the Anti-Federalist card once again.

Within this broad context, he zeros in on one manifestation of the debate sure to draw fire – the power of the federal government to impose potentially onerous taxes on the states.

From the Boston Tea Party to the Whiskey Rebellion, no topic arouses American’s passions like taxation.

In December 1828, even before Jackson is inaugurated, Calhoun decides to stir this pot. He does so in his usual anonymous fashion by penning a document called the “South Carolina Exposition and Protest” – attacking the 1828 Tariff he himself advanced in cynical fashion to undermine Adams.

His basic “exposition” is that the Tariff of 1828 was constitutionally flawed, not because it raised revenue, but because the increases were amplified to protect manufacturing industries in the Northeast at the expense of the cotton growers across the South.

From there he argues that when the federal authorities overstep their bounds, it is the right of the sovereign states to decide and act upon a “proper remedy.”

If it be conceded, as it must be by every one who is the least conversant with our institutions, that the sovereign powers delegated are divided between the General and State Governments, and that the latter hold their portion by the same tenure as the former, it would seem impossible to deny to the States the right of deciding on the infractions of their powers, and the proper remedy to be applied for their correction.

Of course, this is essentially the same argument that the Supreme Court ruled on as recently as 1819 in the McColluch v Maryland case — citing the “necessary and proper” clause in the Constitution to favor federal laws over state laws.

The Congress shall have power to make all Laws which shall be necessary and proper for carrying Into execution…the powers vested by this Constitution in the government of the United States.

Calhoun recognizes that if this decision achieves “stare decisis” (settled law) status, it would open the door to future federal efforts to limit or even abolish slavery, an outcome which would go far beyond taxation in its negative impact on the Southern economy.

In 1828 he decides to make anti-federalism his signature issue, still hoping for another try at the presidency.

1790-1830

History Of Tariffs Leading Up To The 1828 Bill

The type of tariffs Calhoun attacks have been used since Washington’s time by various Treasury Secretaries to fund government spending.

They entail a duty or tax levied on imported goods, collected at ports of entry by customs agents, before cargo ships can be unloaded. They are enforced by an infant coast guard on hand to curb any attempts at smuggling.

In 1790 the average tariff rate across goods is 10.0% and it generates $10.8 million, or 83.7% of total federal income. The rate remains fairly stable over time, and it actually decreases in 1815.

Tariff Rates And Revenue Generated: 1800-1815

| Year | Tariff Rate | Tariff $ (MM) | Total Budget (MM) | % Federal Income Tariff |

| 1800 | 10.0% | $10.8 | $12.9 | 83.7% |

| 1805 | 10.7% | $13.6 | $14.3 | 95.4% |

| 1810 | 10.1% | $9.4 | $10.3 | 91.5% |

| 1815 | 6.5% | $15.7 | $33.8 | 46.4% |

That trend reverses itself when debts associated with the War of 1812 force Madison’s Treasury head, Alexander Dallas, to propose sharp increases on a range of imports in 1816.

Cotton and woolen duties jump to 25% for three years; iron bar, leather, writing paper, hats and cabinet ware go to 30%; and each lb. of sugar is charged 3 cents. The fact that Britain is hit hardest by these changes sparks some patriotic overtones, and the Dallas Tariff passes the House 88-54.

But that will prove to be the last smooth sail for tariff bills in the Congress.

As Monroe’s second term winds down, support widens for a tariff designed to encourage the public to buy goods manufactured in America – by raising the duty, hence the price, on foreign imports.

The 1824 Tariff is focused on four commodities – iron, lead, hemp and cotton bagging – that are particularly important to Rhode Island and Connecticut, along with the north western states from Ohio through Illinois, and the South. All four candidates in the 1824 presidential race support the bill, but both cotton and shipping factions are concerned about its economic impact on their interests.

After serious floor battles, the bill squeaks by on a 107-102 vote in the House. By 1825 the average tariff rate has jumped to 22.3% and the revenue generated accounts for nearly 98% of the total federal budget.

Tariff Rates And Revenue Generated: 1820-25

| Year | Tariff Rate | Tariff Revenue (MM) | Total Budget (MM) | % Total Federal Income Tariff |

| 1820 | 20.2% | $17.9 | $21.3 | 83.9% |

| 1825 | 22.3% | $20.5 | $20.9 | 97.9% |

In 1825, cotton production continues to soar, but the South begins to see some slippage in the price/lb. the commodity commands.

Production And Value Of Cotton

| Year | Lbs (MM) | Cents/Lb | Value | Growth | Tariff |

| 1810 | 68.9 | 14.20 | 9.8 | — | 10.1% |

| 1815 | 81.9 | 25.90 | 21.6 | 220% | 6.5% |

| 1820 | 141.5 | 16.58 | 23.5 | 9% | 20.2% |

| 1825 | 228.7 | 14.36 | 30.9 | 31% | 22.3% |

While this decrease in price might be a response to the spike in supply, the South associates it with the increased tariffs imposed in 1824.

Then comes the so-called “Tariff of Abominations” in 1828 – driving up the tax on imports of finished goods, often made from cotton, to “protect” domestic manufacturing in the northeast.

The response here will be a sharp reduction in prices for cotton and the “Nullification Crisis of 1832,” led by the state of South Carolina and John C. Calhoun.