Section #8 - Efforts to end federal debt, close the U.S. Bank and restore hard currency lead to recession

Chapter 76: Jackson’s “Specie Circular” Triggers A Monetary Crisis

July 11, 1836

Jackson Attempts To Insure The “True Value” Of The US Dollar

From the day he enters office in 1829, Andrew Jackson wars against what he regards as corrupt financial management practices by 1835 he has recorded two victories: shutting down the Second Bank of the United States and paying off the entire federal debt.

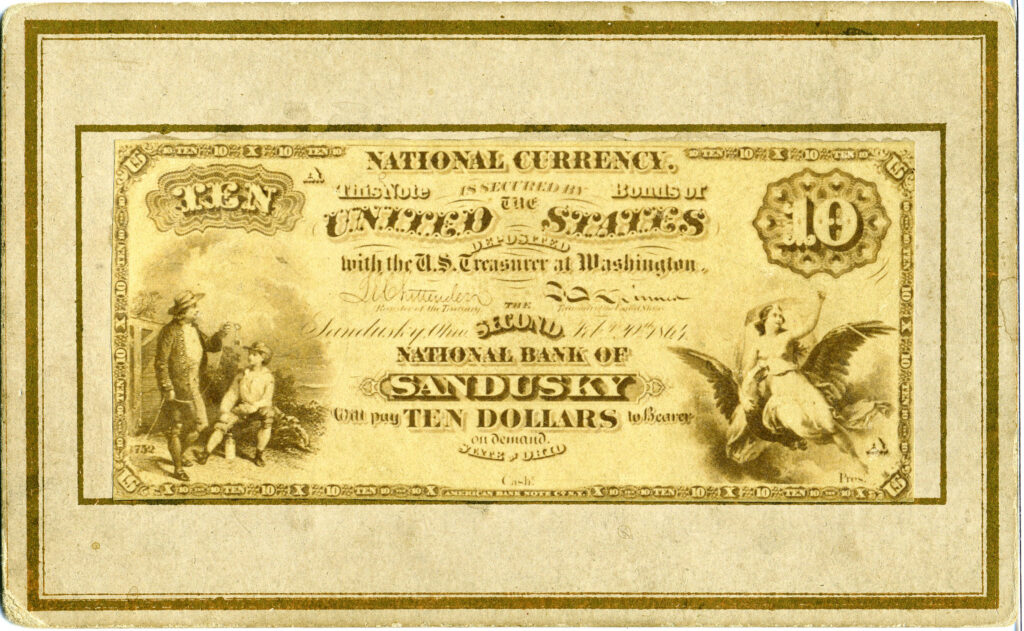

In 1836 he sets his sights on a third objective: protecting the integrity and value of the U.S. dollar against threats he sees from the proliferation of local banks, each allowed to print and issue their own “soft money.”

Between 1820 and 1835, the number of registered banks in America has more than doubled, and the level of loans outstanding has expanded by sevenfold.

Accelerated Growth In U.S. Banking

| Year | Banks | Loans (MM) |

| 1820 | 327 | 55.1 |

| 1825 | 330 | 88.7 |

| 1830 | 381 | 115.3 |

| 1835 | 704 | 365.1 |

The spike in loans signals a spike in personal debt, which is anathema to the fiscally conservative Jackson.

It leads him to reflect again on Hamilton’s scheme to fuel capitalism by increasing the nation’s money supply.

This has been achieved by allowing banks to print a large amount of soft money notes to make loans or investments, with only a small amount of hard gold or silver in their vaults to be “redeemed on demand.”

This whole system seems fundamentally flawed to Jackson.

What can the “true value” of the U.S. dollar be if banks no longer have the capacity to redeem each dollar with the “promised amount of hard specie” (minted gold or silver coins)?

Beyond that, won’t bankers simply print whatever quantities of soft money they deem profitable at any moment in time – and won’t this lead on to ruinous speculation and debt?

Not only for the common man, who is often inclined to borrow more money than he can be sure to pay back, and is crippled by personal IOU’s — but also for the nation.

As a prime example of this, Jackson points to what he regards as the reckless gambles being made in 1835 and 1836 by individuals and bankers on the value of U.S. land.

Accelerated Speculation In U.S. Land

| Year | $ Sales (000) | % Change |

| 1831 | $ 3,200 | |

| 1832 | 2,600 | (19%) |

| 1833 | 3,900 | 50 |

| 1834 | 4,800 | 23 |

| 1835 | 14,750 | 307 |

| 1836 | 24,870 | 69 |

What will happen, he wonders, when the bidding frenzy subsides and speculators find that the true value of the land they bought is much less than they thought? And if, as he suspects, many of the big speculators are the bank owners themselves, will their debt bring down the financial integrity of the entire country?

One thing Jackson knows for certain is his lifelong distrust of, and disdain toward, bankers in general.

Gentlemen, I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You are a den of vipers and thieves.

He is equally certain that his duty lies in acting before it is too late. He will not leave behind a shaky financial outlook as a legacy, when his term is up.

To correct the problem, he must find a way to curtail the rogue printing of the banknotes which fuel speculation, depreciate the real value of the dollar, and result in debt.

He does so by issuing an Executive Order (known as the “Specie Circular”) on July 11, 1836 requiring that future purchases of U.S. land by anyone other than actual settlers be paid off in gold or silver, not in banknotes.

Jackson’s order quickly rocks the foundation of the financial system in place since Alexander Hamilton’s time.

1837-1843

The “Specie Circular” Action Initiates A Financial Panic

The “Specie Circular” is widely regarded as a signal that the federal government itself is uncertain about the intrinsic value of the banknotes already in circulation across the economy.

Why else would the President suddenly be asking land investors to pay off their purchases in hard currency rather than soft banknotes?

As this doubt sinks in, the entire economy begins to witness a flight from dollars back into gold and silver – and a contraction of the nation’s money supply.

The result is a sudden reversal of Hamilton’s entire system of “credit” to support capitalism.

A nation accustomed to borrowing money today — to buy property, to run a farm, to invest in a business – and paying it back with interest later on, now finds that the banks will no longer make these loans.

Worse yet, some banks are even demanding that outstanding loans be repaid immediately to protect the assets of their private owners.

What follows is fear, then bankruptcies and foreclosures.

The old General’s last campaign has found and attacked the vulnerabilities of the “fractional” banking system, and slowed the tide of both public and federal debt. But not without a cost.

The result will be the second extended depression in U.S. history, one which will continue for almost seven years and have a devastating effect on Jackson’s successor, Martin Van Buren.