Section #8 - Efforts to end federal debt, close the U.S. Bank and restore hard currency lead to recession

Chapter 65: Jackson Begins His Assault On The Banking And Monetary Systems

1829-1837

The President Set His Agenda For Financial Reforms

From the time he enters office, Andrew Jackson is determined to put America’s financial house back in order.

His instincts in this regard mirror those of Thomas Jefferson, who, forty years earlier, fought a losing battle to oppose Hamilton’s “new American economy” based on capitalism, an expansion of the “soft money” supply, spending to support industrialization (not just agriculture), and the creation of a federal Bank of the United States.

In Jackson’s mind, this combination has exposed threats to the nation’s financial health.

Too many banknotes (unbacked by gold/silver) are now in circulation, leading to wild speculation, inflation and uncertainty about the true value of the dollar.

Too much control over the fate of the national economy now rests with a few wealthy men who own the corporation known as The Bank of the United States.

Too much federal spending has now resulted in an alarming amount of federal debt. In response to these beliefs, Jackson’s financial remedies will be threefold:

- Tighten control over government spending to eliminate the accumulated federal debt.

- Close the Bank of the United States and deposit all federal revenues collected back in state banks.

- Insure the “true value” of the dollar by demanding that banknotes be properly “backed” by gold/silver.

During his tenure, the President will take decisive action on all three fronts.

1829-1833

The Federal Debt Shrinks Dramatically In Jackson’s First Term

As early as 1824, Jackson calls government debt a “national curse.”

Like Jefferson, he arrives at the position that the government is beholden to whichever entities hold the debt and must be reimbursed – a fact which diminishes its freedom to always act on the best interests of the people.

The magnitude of the constraint is in direct proportion to the size of the debt and the political interests of those who actually possess the IOU’s.

The worst case here would be a high level of indebtedness to a foreign nation, intent on manipulating policies involving America’s security. But danger could also lurk in the form of a domestic oligarchy, with government officials influenced by a small cabal who control the debt and use it as a lever to sway their decisions.

Either way, Jackson views the federal debt as hazardous to the nation’s well-being.

In 1829, at the beginning of his first term, the debt level stands at $58.4 million. To begin to drive it down, Jackson ruthlessly cuts government spending, while raising revenue through increasing the tariff on imported goods and the accelerated sale of federal land.

By 1833, this strategy has reduced the debt by over 90%, down to about $7.0 million.

History Of Federal Debt

| Year | $ (000) | President |

| 1790 | $71,060 | Washington |

| 1795 | 80,748 | Washington |

| 1800 | 82,976 | Adams |

| 1805 | 82,312 | Jefferson |

| 1810 | 53,173 | Jefferson |

| 1815 | 99,834 | Madison |

| 1820 | 91,016 | Madison |

| 1825 | 83,788 | JQ Adams |

| 1826 | $81,054 | JQ Adams |

| 1827 | $73,987 | JQ Adams |

| 1828 | $67,475 | JQ Adams |

| 1829 | 58,421 | Jackson |

| 1830 | 48,565 | Jackson |

| 1831 | 39,123 | Jackson |

| 1832 | 24,322 | Jackson |

| 1833 | 7,002 | Jackson |

December 8, 1829

The President Turns His Sights On The Bank Of The United States

With the debt already decreasing, Jackson pivots to dealing with the threat he senses in the Second Bank of the United States.

Again, like Jefferson, Jackson distrusts the BUS because it appears not only to line the pockets of its corporate owners but also give them sway – via their “lending actions” – over government spending decisions.

This concentration of power in the hands of a few private individuals is anathema to the President, and he vows to do away with it in order to:

Prevent a monied aristocracy from growing up around our administration that must bend to its views, and ultimately destroy the liberty of our country.

Jackson launches his attack on the BUS in his first annual message to congress on December 8, 1829. He questions whether the existence of such a bank is valid under the Constitution – despite the affirmation handed down by the Supreme Court in the March 1819 case of McCulloch v Maryland.

At the same time he announces his growing concerns about the “soft money” supply, and his intent to spread future deposits of the government’s surplus revenue across both the BUS and various state banks.

The owners of the federal bank view the speech as a warning that Jackson might refuse to renew their corporate charter, if he remains president in 1836 when it comes up for renewal.

1791-1836

Sidebar: History Of The Federal Banks Of The United States (BUS)

Both the First and Second Banks of the United States are “corporations,” charted by the federal government, but privately owned by individual stockholders.

The First Bank of the United States is proposed by Hamilton, backed by Washington, and chartered for 20 years by Congress on February 25, 1791. It is located in Philadelphia, the temporary capital city from 1790-1800, while Washington is being built.

After the charter expires in 1811, Madison refuses to re-new it. All outstanding shares are purchased by Steven Girard, a former mariner who starts up a successful ship-building and trading business, and later becomes involved in banking, which makes him fabulously wealthy. Henceforth the Philadelphia establishment becomes known as “Girard’s Bank.”

As the War of 1812 progresses, Madison faces a critical shortage of cash, and offers some $16 million in federal bonds to private investors.

Girard and two other tycoons– John Jacob Astor and David Parrish – purchase most of these securities to “fund the war.”

When the war ends, these three convince Madison to charter a Second Bank of the United States, with a sizable portion of the shares going to them in exchange for their war bonds. On April 10, 1816, Madison authorizes this Second BUS. He faces opposition from many Jeffersonians, but gains support from Henry Clay and John Calhoun.

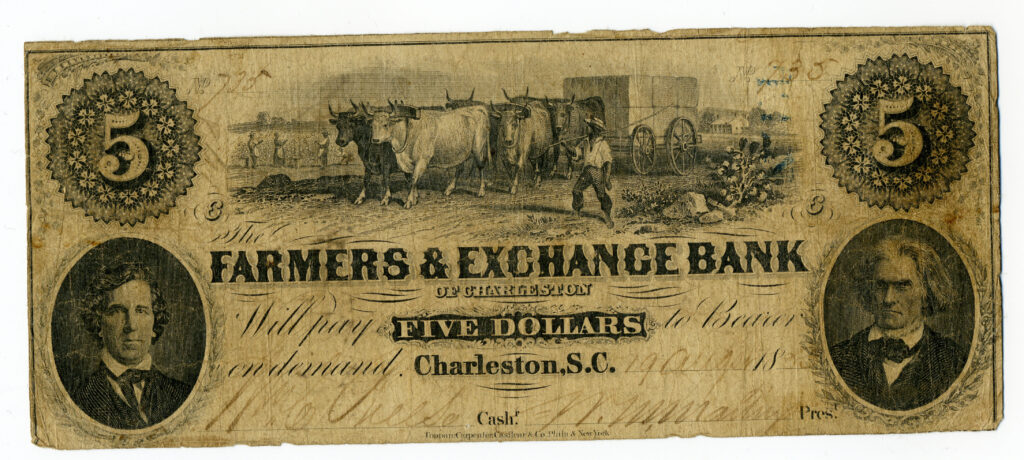

Aside from its lending role, the Second Bank is also expected to carry out a regulatory duty – insuring the value and integrity of the nation’s paper money supply, being printed by State banks.

These State notes flow into the Second Bank on a regular basis, to cover payment of federal duties and tariffs. In return for accepting them, the Second Bank requires that each State bank be willing to “convert” their paper money into gold or silver at any time upon demand.

While this requirement seems foolproof in theory, it quickly falls apart in practice.

As the Napoleonic Wars end, speculators are convinced that demand for American agricultural exports will jump sharply across Europe. What is needed to meet this demand, and make a killing along the way, is western land, with its surplus of fertile soil. The result is a bidding war for land, with borrowers lining up to secure State banknotes and lenders eager to make loans.

Soon enough, the guidelines on the ratio of State banknotes to gold and silver reserves are breeched, while the target was a 5:1 ratio, it becomes 10:1 in practice.

Instead of enforcing its “convertibility” mandate, The Second Bank tries to prop up the State banks by selling off its own supply of gold and silver to them in exchange for their shaky notes.

This artificially props up the State banks until it becomes clear that the forecasted jump in Europe’s demand for American agriculture is not materializing. When Britain also begins to import some of its cotton needs from India, the expected “boom cycle” turn into a “bust.”

From there, all the dominoes begin to fall. In August 1818, stockholders in the Second BUS attempt to protect their assets by requiring the State banks to prove they have sufficient gold and silver specie on hand to support the dollar values on their soft money.

In turn, State banks “call in” loans made to the general public, in search of the hard money now being required by the Second BUS. But neither the land speculators nor the average farmer or business owner are able to pay up so precipitously.

Foreclosures and bankruptcies follow, as does unemployment, homelessness, and bank failures. The Panic of 1819 becomes America’s first major non-war related recession.

A mere two years after re-chartering, public trust in the Second Bank plummets.

More bad news follows when fraud is discovered among Second Bank officers in Baltimore, forcing the bank’s president, William Jones, former Secretary of the Navy, to resign. This is no surprise to the “real financial experts” at the BUS — Girard and Astor – both of whom have questioned Jones’s competency from the start.

For the tried and true Jeffersonians, the Panic of 1819 is simply more evidence that Hamilton’s plan for the U.S. economy is fatally flawed – including his Bank of the United States.

In Andrew Jackson they find just the man to once again shut the BUS down.